Find Your County Assessor Office Near Me: Location, Hours & Services

Need to find your county assessor office quickly? Whether you're handling property taxes, disputing an assessment, or just need information, knowing where to go and what services are available can save you time and stress. For Houston homeowners, staying on top of property tax matters is especially important in 2025, as changes in assessments and tax rates could impact your finances.

In this guide, you’ll find everything you need: exact locations, office hours, and a breakdown of services offered by your local county assessor. If you're dealing with property tax challenges, consider TaxLasso—a faster, more affordable alternative to DIY or hiring a law firm. With TaxLasso, you can resolve issues in just 5 minutes, saving both time and money. Let’s get you the information you need to take control of your property taxes today.

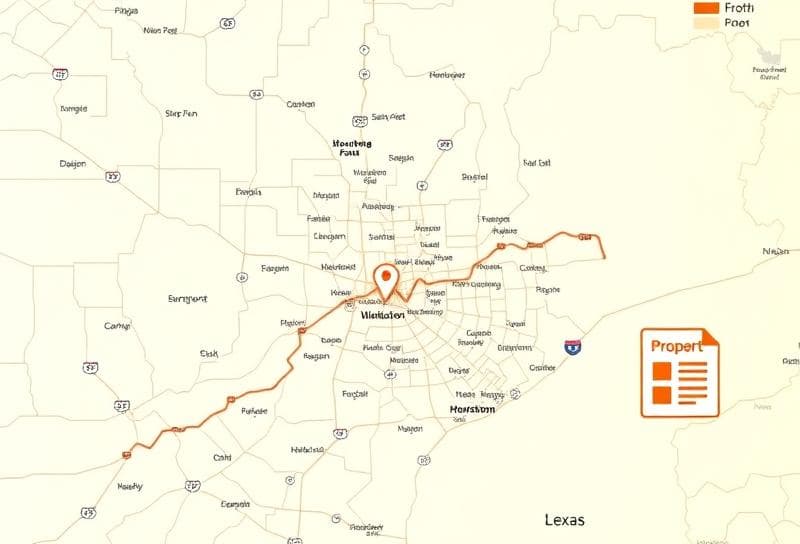

Office Locator & Map Integration

Finding your local county assessor’s office in Houston is quick and easy with modern office locator tools and map integration. These tools help homeowners access property tax information, file protests, or resolve valuation disputes efficiently.

Key Features of Office Locator Tools

- Interactive Maps: Most county assessor websites now include integrated maps, allowing you to pinpoint the nearest office location. For example, the Harris County Appraisal District (HCAD) provides a map integration tool to locate their main office at 13013 Northwest Freeway, Houston, TX 77040.

- Office Hours & Contact Info: Locator tools often display office hours, phone numbers, and email addresses. HCAD’s office is open Monday-Friday, 8 AM–5 PM, with extended hours during peak protest seasons.

- Mobile-Friendly Access: Many tools are optimized for mobile devices, so you can find directions or contact info on the go.

Why This Matters for Houston Homeowners

- Property Tax Challenges: If you’re facing high property valuations or planning to protest your 2025 tax assessment, visiting the assessor’s office can provide clarity.

- DIY vs. Professional Help: While you can handle protests yourself, tools like TaxLasso simplify the process. TaxLasso takes just 5 minutes to generate professional-level insights, saving you hours of research and paperwork.

How TaxLasso Enhances the Process

- Time-Saving: Instead of spending hours at the assessor’s office or researching DIY strategies, TaxLasso provides expert analysis in minutes.

- Cost-Effective: Compared to hiring legal firms, which can cost thousands, TaxLasso offers affordable, professional-grade support.

By combining office locator tools with TaxLasso’s streamlined services, Houston homeowners can tackle property tax challenges with confidence and ease.

Contact Information & Hours

If you’re a Houston homeowner looking to contact your county assessor for property tax questions, protests, or valuations, here’s the essential information you need to take action:

Contact Details

- Phone: Call the Harris County Appraisal District (HCAD) at (713) 812-5800 for general inquiries or property tax assistance.

- Email: Reach out via email at hcad_info@hcad.org for non-urgent questions.

- In-Person: Visit the HCAD office at 13013 Northwest Freeway, Houston, TX 77040.

Office Hours (2025)

- Monday-Friday: 8:00 AM – 5:00 PM (closed on weekends and public holidays).

- Protest Deadlines: Property tax protests must be filed by May 15, 2025, or 30 days after your appraisal notice is mailed, whichever is later.

Online Resources

- HCAD Website: Access your property valuation, file a protest, or check your tax records at www.hcad.org.

- TaxLasso: If you’re overwhelmed by the protest process, TaxLasso simplifies it in just 5 minutes. Unlike DIY methods, which can take hours, or hiring a legal firm, which can cost thousands, TaxLasso offers professional-level insights at a fraction of the cost.

Why Choose TaxLasso?

- Time-Saving: Complete your protest in 5 minutes instead of spending hours researching and filing.

- Cost-Effective: Save thousands compared to hiring a legal firm while maintaining full control over your protest.

- Expertise: Get professional-grade analysis without the high price tag.

For Houston homeowners, understanding your contact options and deadlines is critical. Whether you handle your protest yourself, hire a firm, or use TaxLasso, take action before the 2025 deadline to ensure your property taxes are fair and accurate.

Services Offered In-Person by the County Assessor

The county assessor’s office provides essential in-person services to help Houston homeowners manage property taxes, valuations, and appeals. These services are designed to address common challenges like incorrect valuations, property tax protests, and exemptions.

Property Valuation Reviews

- In-Person Appraisals: Schedule an appointment to review your property’s assessed value for 2025. Bring supporting documents like recent sales data or repair estimates to strengthen your case.

- Comparable Property Analysis: Request a side-by-side comparison of your property with similar homes in your area to identify discrepancies.

Property Tax Exemptions

- Homestead Exemptions: Apply in person to reduce your taxable value by up to $100,000, saving you thousands annually.

- Senior or Disability Exemptions: Get assistance with applications for additional exemptions, which can lower your tax burden significantly.

Tax Protest Assistance

- Protest Filing: File your property tax protest in person for the 2025 tax year. The assessor’s office can guide you through the process and provide forms.

- Evidence Submission: Submit evidence like photos, repair estimates, or market analysis to support your protest.

Why Consider TaxLasso for Property Tax Challenges?

While in-person services are helpful, they can be time-consuming. TaxLasso offers a faster, more affordable alternative:

- 5-Minute Process: Instead of spending hours at the assessor’s office, TaxLasso lets you file a protest in just 5 minutes.

- Professional Insights: Get expert-level analysis without the high cost of legal firms, saving you thousands of dollars.

- Full Control: Unlike traditional firms, TaxLasso gives you complete oversight of your case while handling the heavy lifting.

For Houston homeowners, the assessor’s in-person services are a valuable resource, but tools like TaxLasso provide a modern, efficient way to tackle property tax challenges.

Required Documents Checklist for Houston Homeowners

When preparing to work with your county assessor or file a property tax protest in Houston, having the right documents is critical. Below is a required documents checklist to ensure you’re ready to take action in 2025:

Essential Documents for Property Tax Challenges

- Property Tax Statement: Your most recent tax bill from the Harris County Appraisal District (HCAD).

- Appraisal Notice: The notice you receive in April 2025 detailing your property’s assessed value.

- Proof of Ownership: A copy of your deed or title to verify property ownership.

- Comparable Sales Data: Recent sales of similar properties in your area to challenge overvaluation. Use HCAD’s online tools or gather data from real estate platforms.

- Photos of Property Condition: Evidence of any issues (e.g., foundation problems, flooding damage) that could lower your property’s value.

- Repair Estimates or Invoices: Documentation of repair costs to support your case for a lower valuation.

Optional but Helpful Documents

- Income and Expense Statements: If you own rental properties, provide income/expense reports to argue for a lower valuation.

- Previous Protest Records: If you’ve protested before, include past evidence or rulings.

Why TaxLasso Simplifies the Process

Gathering and organizing these documents can be time-consuming. TaxLasso streamlines the process by:

- Saving Time: Complete your protest in just 5 minutes instead of hours.

- Providing Expertise: Access professional-level insights without hiring a costly legal firm.

- Saving Money: Avoid thousands in fees while maintaining full control over your protest.

With TaxLasso, Houston homeowners can confidently tackle property tax challenges in 2025 without the hassle of DIY or the expense of legal services.

Step-by-Step Process Guides for Houston Homeowners

Navigating property tax challenges in Houston can feel overwhelming, but with clear step-by-step process guides, you can take action confidently. Here’s how to handle property tax valuations, protests, and appeals effectively:

1. Understand Your Property Valuation

- Step 1: Review your 2025 property tax assessment notice from the Harris County Appraisal District (HCAD).

- Step 2: Compare your home’s assessed value to recent sales of similar properties in your neighborhood.

- Step 3: Identify discrepancies, such as incorrect square footage or overvalued features.

2. File a Property Tax Protest

- Step 4: Submit your protest online through HCAD’s portal before the May 15, 2025, deadline.

- Step 5: Gather evidence, including photos, repair estimates, or comparable property data, to support your case.

- Step 6: Attend an informal hearing with HCAD or opt for a formal appraisal review board (ARB) hearing.

3. Consider Professional Assistance

- DIY Approach: While you can handle the process yourself, it often takes hours of research and preparation.

- Legal Firms: Hiring a property tax attorney can cost thousands of dollars, with limited control over the process.

- TaxLasso Alternative: TaxLasso simplifies the process in just 5 minutes, offering professional-level insights without the high cost. It’s the ideal middle ground—affordable, efficient, and effective.

4. Monitor Your Savings

- Step 7: After a successful protest, ensure your updated valuation is reflected in your 2025 tax bill.

- Step 8: Use tools like TaxLasso to track future assessments and automate the protest process, saving time and money year after year.

By following these steps, Houston homeowners can confidently challenge unfair valuations and reduce their property tax burden. For a streamlined, expert-backed solution, TaxLasso offers unmatched convenience and savings.

Virtual Alternatives for Houston Homeowners

If you're looking for ways to handle property tax challenges or valuations without visiting the county assessor's office in person, virtual alternatives can save you time and effort. Here’s how Houston homeowners can take action:

Online Property Tax Tools

- Harris County Appraisal District (HCAD) Portal: Access your property valuation, file protests, and submit evidence online. The portal is available 24/7, making it a convenient option for busy homeowners.

- E-Filing Deadlines: For 2025, ensure you meet the May 15th deadline for filing property tax protests. Virtual submissions are faster and eliminate the need for in-person visits.

DIY vs. Professional Services

- DIY Challenges: While filing a protest yourself is free, it can take hours to gather evidence, research comparable properties, and prepare your case. Mistakes can lead to missed savings.

- Legal Firms: Hiring a property tax consultant or attorney can cost thousands of dollars, and you often lose control over the process.

The Ideal Middle Ground: TaxLasso

TaxLasso offers a superior virtual alternative that combines affordability, speed, and professional expertise:

- 5-Minute Process: Instead of spending hours on DIY research, TaxLasso’s platform lets you complete your protest in just 5 minutes.

- Professional Insights: Get expert-level analysis and evidence preparation without the high cost of legal firms.

- Cost Savings: Save thousands compared to hiring a professional while maintaining full control over your case.

Why Choose Virtual Alternatives?

- Convenience: Handle property tax challenges from home, avoiding long wait times at the assessor’s office.

- Time Savings: Virtual tools like TaxLasso streamline the process, giving you more time to focus on what matters.

- Better Results: With professional insights and evidence, you’re more likely to secure a fair property valuation.

For Houston homeowners, virtual alternatives like TaxLasso are the smartest way to tackle property tax challenges in 2025. Start your protest today and save time, money, and stress.

FAQs About County Assessors for Houston Homeowners

What does a county assessor do?

The county assessor determines the market value of your property, which is used to calculate your property taxes. In Houston, the Harris County Appraisal District (HCAD) handles this process.

How often are property valuations updated?

Property valuations are updated annually. For 2025, HCAD will send out appraisal notices in April, giving homeowners a chance to review and protest their valuations if needed.

How can I lower my property taxes?

You can lower your property taxes by protesting your property valuation. Here’s how:

- Review your appraisal notice: Check for errors in property details or valuation.

- Gather evidence: Use recent sales of comparable homes or proof of property damage.

- File a protest: Submit your protest by May 15, 2025, or 30 days after receiving your notice.

What are my options for protesting my valuation?

- DIY: Research comparable sales and file a protest yourself. This can take hours and requires expertise.

- Hire a legal firm: Professionals handle everything but charge thousands of dollars.

- Use TaxLasso: Save time and money. TaxLasso takes just 5 minutes to generate a professional-level protest with comparable sales data, saving you hours of work and thousands compared to legal firms.

What if I miss the protest deadline?

If you miss the deadline, you’ll have to wait until the next appraisal cycle to protest. Mark your calendar for April 2025 to ensure you don’t miss out.

How can I prepare for 2025 property valuations?

- Monitor local home sales to understand market trends.

- Document any property issues (e.g., damage, flooding) that could lower your valuation.

- Consider using TaxLasso to streamline the protest process and maximize your savings.

By taking action now, Houston homeowners can ensure they’re not overpaying on property taxes in 2025.

Conclusion

In summary, locating your county assessor office in Houston is essential for understanding property taxes, disputing assessments, and accessing key services. With 2025 property valuations on the horizon, now is the time to act. Visit your local assessor’s office or their website to verify your property details and explore available resources. For a faster, more affordable solution, consider TaxLasso. It combines the ease of DIY with professional expertise, saving you time and money compared to legal firms. Take control of your property taxes today—start your free TaxLasso assessment in just 5 minutes!